🇪🇸 Rescued €8,000 from Predatory Life Insurance

Rescued €8,000 from predatory 1.7% fee life insurance and built +€500K children's education fund

The Challenge:

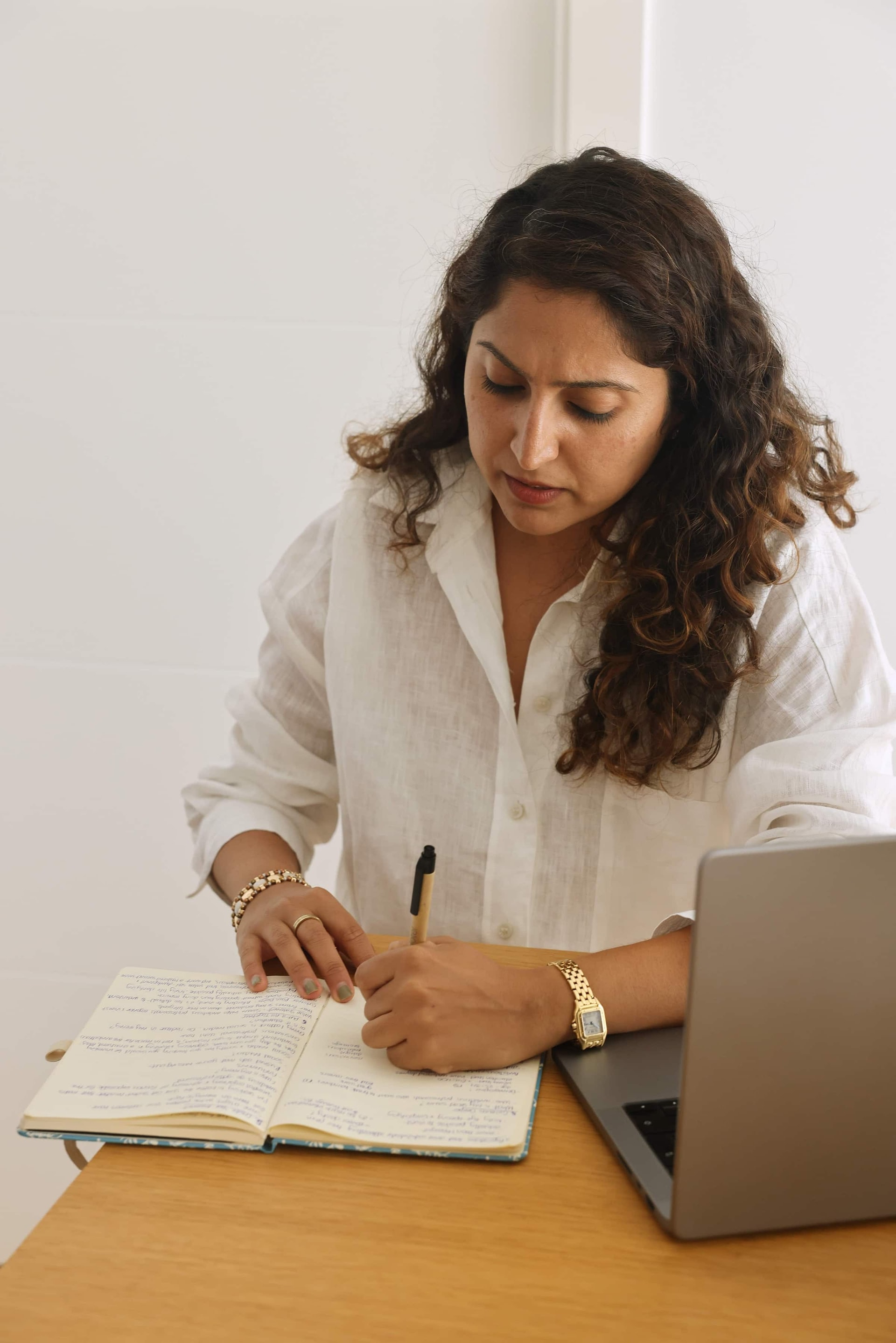

A business owner in her 30s in Spain earned a strong income but felt her money was going nowhere. She had unknowingly locked savings into a high-fee life insurance product and carried a deep fear of investing, shaped by childhood money conditioning. On top of that, she worried about securing her two sons’ futures without any clear financial education.

Our Solution:

Through a tailored financial coaching program, we helped Noori rescue her money, rebuild her confidence, and create a long-term plan:

Phase 1 - Product Recovery: Analysed full 86-page life insurance policy revealing 1.7% annual fees, early withdrawal penalties, and market-dependent death benefits. Coordinated with Spanish accountant on tax implications of withdrawals, and executed full principal recovery strategy.

Phase 2 - Mindset Transformation: Addressed childhood money conditioning that linked spending to conditional approval. Reframed money relationship from fear-based to values-based, enabling empowered financial decisions aligned with family goals.

Phase 3 - Investment Education: Designed a low-cost, diversified ETF strategy with an automated system focused on funding her children’s education and future security.

Financial Transformation:

Recovered full €8,000 principal from predatory life insurance scheme

Built a secure family emergency fund for peace of mind

Half a million euros projected in investment returns over a 30-year period for her sons' education

Eliminated 1.7% annual fees saving thousands in unnecessary costs over time

Shifted from financial fear to clarity and confidence

Life Impact Beyond Numbers:

Gained time and peace of mind with her family

Protected her household from risky investment habits

Accelerated progress toward her dream of homeownership

Rebuilt trust in her ability to make sound financial decisions

Spanish Tax Optimization:

Coordinated with local accountant to ensure tax-efficient investment structure

Navigated Spanish investment regulations for any ETF investment implications

Important Disclosure:

Spanish tax considerations mentioned are for educational purposes only and do not constitute tax advice. Always consult qualified Spanish tax professionals for personal situations.

Here's what she had to say:

“I thought this program would be like, ‘put your money in these ETFs, they will make you money.’ But Sanam went beyond this. She made me understand the fundamentals so I could choose the ETFs myself and understand my portfolio properly. She made me realise it’s possible to invest on my own for future financial stability."